Industrial peak shaving demand charges significantly impact manufacturing profitability, often inflating energy costs by a substantial margin. To protect margins, adopting strategic solutions that enhance return on investment (ROI) is essential. While Battery Management Systems (BMS) focus on safety and real-time protection, Energy Management Systems (EMS) optimize economic dispatching to turn energy from a cost center into a strategic asset. In high-cost energy markets like Germany and the US, leveraging advanced lithium-based strategies is a competitive necessity to ensure energy flexibility and operational resilience.

Key Takeaways

Peak Shaving ROI: Implementing strategic load balancing can significantly lower demand charges and enhance overall factory ROI.

Intelligent EMS Dispatching: Utilizing a Smart EMS allows for real-time energy optimization, reducing reliance on expensive grid power during peak periods.

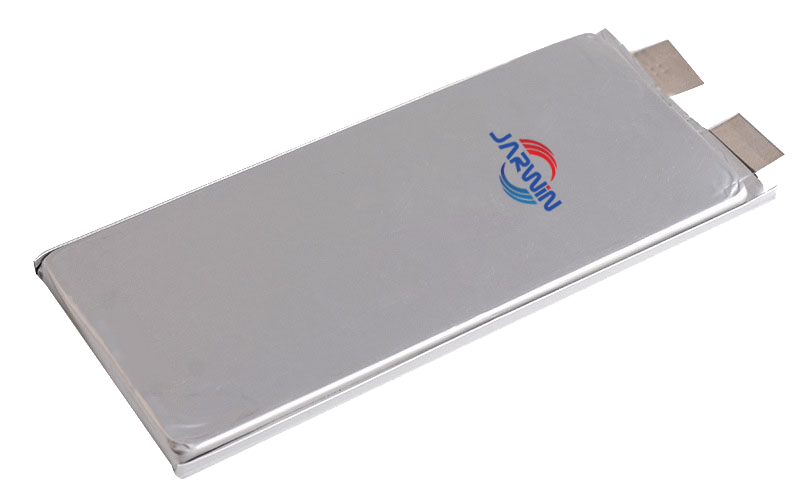

The Lithium Advantage: Transitioning to lithium provides a 3,000 – 5,000 cycle service life, lasting 3x longer than lead-acid with virtually maintenance-free requirements.

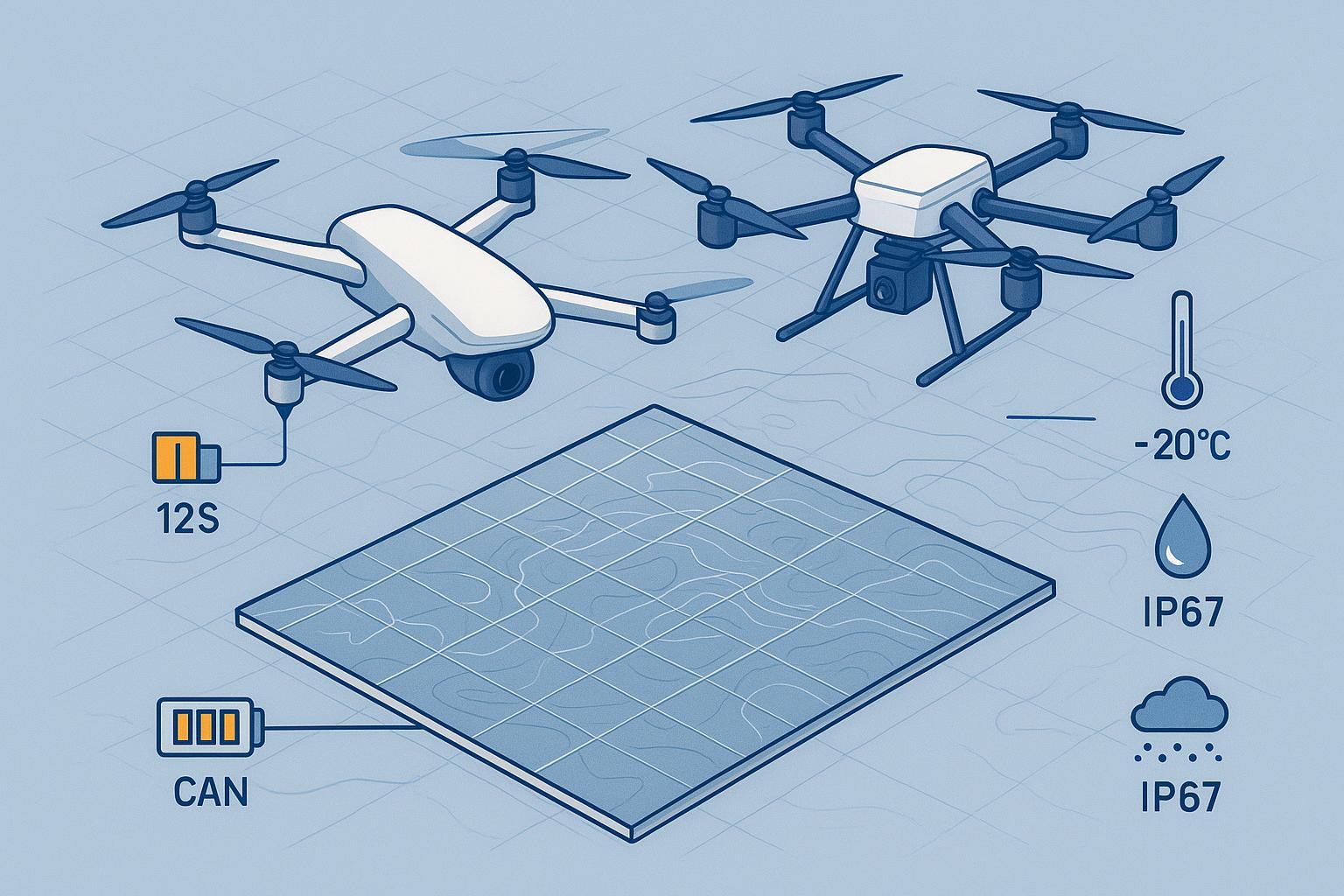

Environmental Reliability: Advanced systems maintain stable performance in extreme industrial environments, ranging from -20°C to 60°C.

Scalable Efficiency: Modular energy storage solutions allow factories to scale power systems precisely according to specific operational needs, future-proofing the investment.

Why Peak Demand is Killing Factory Profits

The Hidden Costs of Power Volatility

Power volatility and sudden demand spikes significantly impact manufacturing operations, creating hidden costs that erode profitability far beyond the monthly utility bill. When fluctuations in electricity supply occur, facilities face severe operational consequences:

Material Waste: For industries like plastics, food processing, or pharmaceuticals, even a momentary power interruption can ruin entire batches of products. This leads to significant losses in raw materials, labor hours, and disposal costs.

Production Delays: Unpredictable power supply halts automated production lines, delaying orders and reducing revenue. The “restart time” required to recalibrate machinery after a dip can often cost more than the outage itself.

Equipment Damage: Sudden voltage fluctuations can harm sensitive industrial machinery and control systems, incurring additional repair costs and shortening asset lifespan.

These factors contribute to an environment where operational efficiency suffers. Managing power effectively is no longer just a facility task; it is a crucial strategy for maintaining global competitiveness.

How Demand Charges Drain Your ROI

Demand charges represent one of the most significant expenses for modern manufacturers. These charges are triggered when your facility exceeds a predetermined electricity usage threshold during peak hours, forcing you to pay a high premium for the energy consumed during those windows.

To mitigate these charges, you should consider implementing Industrial Peak Shaving strategies. By optimizing energy consumption and utilizing demand response techniques, you can effectively cap your peak demand. This transition from reactive consumption to strategic load balancing delivers:

Lowered Operational Costs: Directly reducing the “peak premium” on your energy bill.

Enhanced Energy Efficiency: Leveraging lithium storage to utilize energy more intelligently across shifts.

Improved Long-term ROI: Achieving up to a 30% reduction in Total Cost of Ownership (TCO) over a five-year period.

In high-cost energy markets, transforming energy management from a cost center into a competitive advantage is essential for survival.

Mastering Peak Shaving with Smart EMS

How EMS Intelligent Dispatching Drives Efficiency

Implementing a Smart Energy Management System (EMS) can significantly enhance your factory’s efficiency. Intelligent dispatching allows you to optimize energy consumption by analyzing real-time data and adjusting power usage accordingly. Here are some key advantages of using EMS for peak shaving:

Self-Consumption Optimization: By managing when and how you use energy, you can maximize self-consumption of renewable energy sources, reducing reliance on grid power during peak hours and leading to substantial cost savings.

Load Shifting: You can shift energy-intensive processes to off-peak hours when electricity rates are lower. This strategy not only lowers your energy costs but also helps flatten your energy consumption curve.

Electricity Trading: With an EMS, you can participate in electricity trading. By selling excess energy back to the grid during peak demand times, you can generate additional revenue.

By adopting these strategies, you can effectively lower your peak demand charges and enhance your overall ROI. Reports indicate that factories implementing advanced peak shaving strategies can reduce specific demand charges by up to 60% compared to traditional methods.

Achieving this 60% reduction requires more than intelligent algorithms; it necessitates high-rate lithium hardware capable of rapid discharge to “shave” the most aggressive power spikes within narrow grid windows.

BMS vs. EMS: Balancing Safety and Profitability

Understanding the differences between Battery Management Systems (BMS) and Energy Management Systems (EMS) is crucial for optimizing both safety and profitability in your operations.

The following table summarizes their specific impacts:

Aspect | BMS Impact | EMS Impact |

Operational Efficiency | Ensures cells run within safe limits to maintain a 10+ year lifespan. | Enhances energy usage efficiency through intelligent economic dispatching. |

Safety | Reduces dependency on manual monitoring by providing real-time thermal/voltage protection. | Monitors integrated energy systems for overall grid and load safety. |

Profitability | Lowers operating costs by preventing premature battery failure and minimizing replacements. | Increases cost savings, driving up to a 30% reduction in TCO through active demand management. |

While BMS focuses primarily on the safety and performance of battery systems, EMS takes a broader approach. It integrates various energy sources and optimizes their usage, leading to improved profitability. By leveraging smart load management and Herewinpower’s high-performance lithium architecture, you can ensure that your factory operates safely while maximizing every kilowatt of energy efficiency.

10-Year TCO: Why Lithium Wins on ROI

Comparing Life-Cycle Costs: Lithium vs. Lead-Acid

When evaluating the life-cycle costs of lithium versus lead-acid batteries, manufacturers must look beyond the initial invoice. While lead-acid batteries may offer a lower upfront purchase price, advanced lithium-ion infrastructure offers significant total savings over a 10-year operational horizon. To maintain strategic consistency across your energy fleet, consider these critical cost drivers:

Initial Investment vs. Longevity: Lead-acid batteries are cheaper upfront but often require multiple replacements within a decade, whereas a single high-performance lithium system is engineered for 10+ years of reliable service.

Maintenance & Labor: Lead-acid units demand regular watering, cleaning, and equalization, incurring heavy labor costs. Lithium is virtually maintenance-free, eliminating routine manual intervention and allowing you to redirect skilled staff to core production.

Thermal Efficiency: Modern lithium systems maintain high performance across a wide temperature spectrum (-20°C to 60°C), significantly reducing the need for expensive climate-controlled charging rooms.

Cycle Life: With a rating of 3,000 – 5,000 cycles, lithium-ion technology lasts 3x to 4x longer than traditional lead-acid alternatives, leading to far fewer asset replacements.

Leveraging Cycle Life for Long-term Gains

The cycle life of a battery is the primary engine of its ROI. Over a 10-year period, a lithium-based energy storage system can be up to 30% less expensive than lead-acid due to its superior efficiency and lack of replacement downtime.

Industrial Energy System Comparison:

Feature | High-Performance Lithium-Ion | Traditional Lead-Acid Batteries |

Operational Temperature | -20°C to 60°C (Extremely Resilient) | Strictly requires ~20°C for optimal lifespan |

Service Life | 3,000 – 5,000 Cycles (10+ Years) | 1,000 – 1,500 Cycles (3–5 Years) |

Maintenance Costs | Virtually Maintenance-Free | High (Requires strict temperature & fluid control) |

Long-term Cost-effectiveness | High (Amortized over 10+ years) | Low (Frequent replacements and high OPEX) |

By leveraging the extended cycle life of lithium batteries, you achieve long-term gains that translate into substantial bottom-line savings. Additionally, these systems enhance renewable energy utilization, helping your facility align with global carbon neutrality goals.

Slashing OPEX with Low-Maintenance Power

Cutting Costs with Predictive Diagnostics

Predictive diagnostics play a crucial role in reducing operational costs in modern industrial settings. By utilizing AI and IoT technologies, facilities can monitor energy consumption and battery health in real time. This proactive approach identifies inefficiencies early and allows maintenance to be scheduled during non-peak hours, minimizing interruptions and maximizing operational efficiency.

Consider the following verified benefits of implementing predictive diagnostics for your power infrastructure:

Benefit | Projected Operational Impact |

5 – 10% | |

Increase in Plant Availability | 10 – 20% |

Reduction in Machine Downtime | 35 – 50% |

Extension of Equipment Lifespan | 20 – 40% |

By shifting from reactive to predictive maintenance, factories can significantly lower the 15% to 40% of production costs typically spent on maintenance. This transition not only enhances the bottom line but also improves overall grid and operational reliability.

Solving the Labor Crisis in High-Cost Markets

In high-cost markets like Europe and North America, labor shortages and rising wages pose significant challenges to factory profitability. Low-maintenance power solutions alleviate these pressures by eliminating the need for frequent manual interventions.

By adopting a maintenance-free architecture, you can optimize your workforce and redirect skilled labor to more critical production tasks. Furthermore, proper sizing of your energy storage system—determined by your facility’s specific load profile—ensures that energy consumption is managed with surgical precision.

Investing in high-performance, low-maintenance power does more than cut OPEX; it builds a resilient factory capable of thriving in a competitive global market.

Herewinpower: Scalable Energy Solutions for Global Industry

Modular Scalability for Any Power Requirement

We offers modular energy storage solutions engineered to adapt seamlessly to your facility’s specific load profile. This flexible architecture allows you to scale energy capacity in alignment with operational growth, ensuring optimal cost management.

The strategic advantages of modular scalability include:

Capital Efficiency: Invest in a system that meets current demand, avoiding excessive upfront CAPEX on unutilized capacity.

Future-Proof Infrastructure: As production lines expand, additional modules can be integrated without overhauling existing electrical systems.

Optimized Peak Shaving: Modular arrays ensure consistent energy availability, a critical requirement for managing aggressive peak demand windows.

Industrial energy storage is a sound financial investment. Many facilities achieve full amortization within 4 to 8 years, transforming energy management into a long-term profit driver.

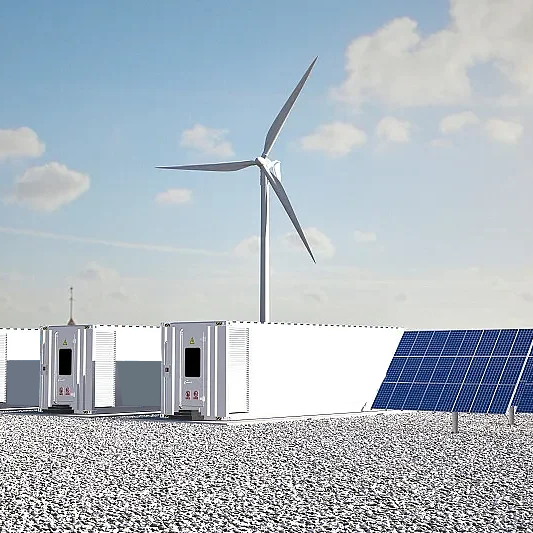

Certified Reliability in Demanding Environments

In high-stakes industrial environments, reliability is the ultimate safeguard against financial loss. Our lithium infrastructure—demonstrated through successful large-scale deployments like our Integrated Wind & Solar Storage projects—is engineered to deliver stable power even under extreme operational stress.

Mitigating Downtime Risk: A single major outage can cost a factory tens of thousands of dollars in spoiled materials and lost productivity; our systems act as a critical buffer against grid instability.

Enhanced Power Stability: For high-capacity operations, our 1MWh energy storage solutions provide the consistent voltage stability required to keep precision automated lines running smoothly—a performance standard verified across global industrial sites.

Maximizing Self-Consumption: By intelligently buffering onsite renewable energy, you lower overall utility bills and accelerate your factory’s ROI.

By integrating Herewinpower’s data-driven energy management, facilities gain more than advanced hardware—they establish a scalable power infrastructure optimized for the evolving demands of global industry.

The transition to high-performance lithium energy storage is no longer just a sustainability goal—it is a strategic necessity for maintaining manufacturing margins in an era of fluctuating energy costs. To accurately assess the ROI potential for your facility, we recommend conducting a comprehensive energy audit to map your specific load profile against current peak demand rates.

For a detailed analysis or to explore a customized Herewinpower solution for your facility, please feel free to reach out to us for a professional consultation.

FAQ

What is peak shaving?

Peak shaving refers to strategies that reduce energy draw from the grid during peak demand periods. By utilizing stored energy to “cap” these spikes, you can significantly lower demand charges and protect your factory’s profit margins.

How can I implement peak shaving in my factory?

Implementation requires a synergy of Smart EMS (Energy Management Systems) and high-rate battery hardware. Key strategies include load shifting (moving heavy tasks to off-peak hours) and self-consumption (storing onsite renewable energy for peak use).

What are the benefits of lithium batteries over lead-acid batteries?

Lithium batteries offer a 3,000 – 5,000 cycle life, lasting 3x to 4x longer than lead-acid alternatives. They are 100% maintenance-free and maintain stable performance in extreme industrial environments ranging from -20°C to 60°C.

How does predictive maintenance help reduce operational costs?

By utilizing AI and IoT, predictive maintenance monitors battery health and load profiles in real-time. This proactive approach can reduce machine downtime by 35-50% and extend overall equipment lifespan by identifying inefficiencies before they lead to failure.

Can Herewinpower solutions be customized for my specific needs?

Yes. Effective peak shaving depends on accurate load profile analysis. Solutions are modular and scalable, allowing you to tailor energy capacity to your current requirements while remaining future-proof for future expansions.

See Also

Boosting AGV Fleet Returns Through Enhanced Lithium Performance

Opportunity Charging: Reducing Downtime and Maintenance for Forklifts

Transitioning to Lithium: Cutting Costs for Senior Mobility Solutions

Addressing Cold Storage Battery Uptime and Performance Issues

Effective RV Lithium Planning: Strategies for 200Ah to 600Ah